As per the survey conducted back in 2019, it has been noticed that 40000 crores of unclaimed amounts lie with the PF office, which means the PF office is earning Rs 4000 crores of interest on these amounts annually. In 2016, the SCWF (Senior Citizen Welfare Fund) was established by the Government of India. If the EPF amount is not claimed in 7 years and the post-account has been classified as inoperative, the amount remaining in it is to be transferred by default to SCWF.

So post-transfer of the amount to SCWF, the employee or claimant has 25 years to claim the amount. Also, the nominee of the EPF account can also make a claim in case of any mishap. After a period of 32 years subsequent to an account being categorised as inoperative, the unclaimed amount shall be escheated (presumed that the employee, owner, or nominee died without legal heirs) to the central government.

Below are the steps to be followed for claiming the hard-earned EPF amount online:

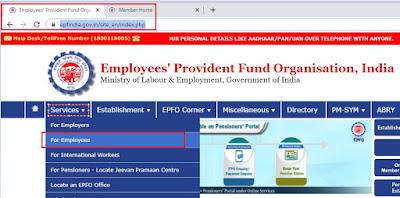

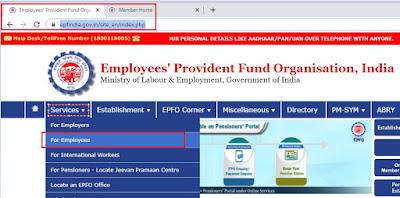

- Employees must create UANs (Universal Account Numbers) using their PF numbers, which can be found on their pay stubs. So once the PF number is identified, login to the EPFO website and click on the Services tab. Choose For Employees from the drop down menu.

|

| Step 1 - Login to EPFO and Click on Employees Option |

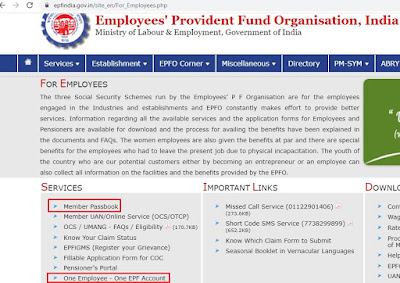

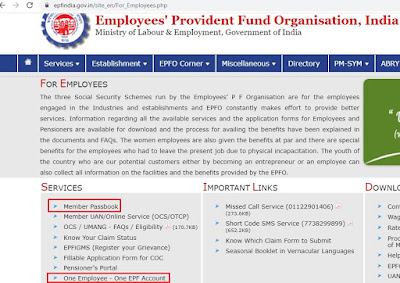

- Click on the One Employee, One EPF Account option, and then click on the Activate UAN option after inputting PF details, PAN details, or Aadhar details from the salary slip. One can also (already registered) download the Member Passbook, with the help of which total PF contribution amount details can be obtained.

|

| Step 2 (a) - One Employee One PF option |

|

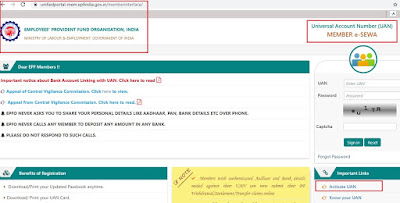

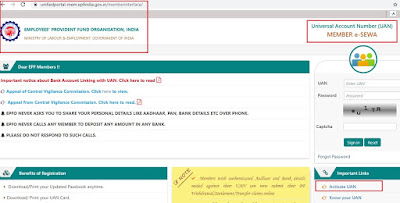

Step 2 (b) - Activate UAN / Login Page

|

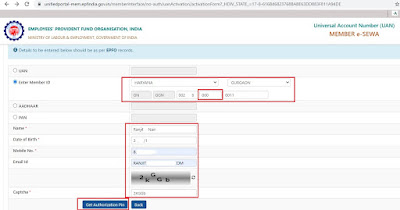

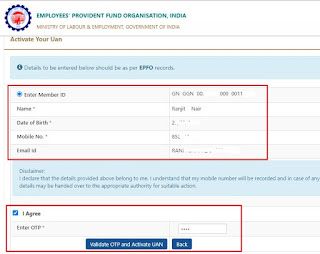

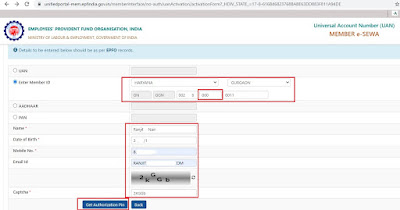

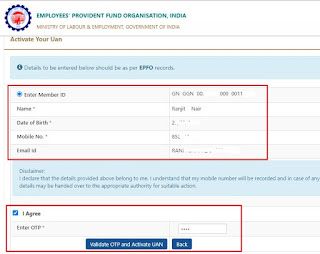

- Register to generate UAN with the help of the PF number available on the salary slip. Click on Enter Member ID and select State and office details based on PF number. One needs to correctly mention the details; otherwise, the details will not fetch government records on the database. Also note while inputting EST EXT, which always is 000. Post that, fill in the name, date of birth, mobile number, email address, and correct captcha details, and click on Get Activation Pin. One will get an OTP to activate the UAN over the registered mobile number provided at the time of the activation code generation window.

|

| Step 3 (a) PF Details window |

|

| Step 3 (b) UAT Activation window via OTP |

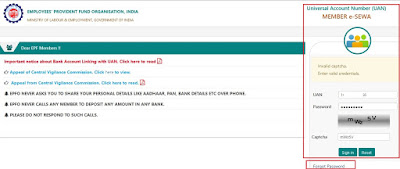

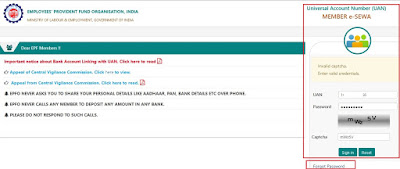

- Once the UAN number was generated, half of the task was accomplished. Now the next step is to login to the portal for EPF amount transfer or withdrawal using the UAN and password. If passwords are not set, one can login via the OTP option, and after login, one can generate a password. Also, post-login, the employee or beneficiary will be able to register the nominee online and will get the option for fund transfer, combining multiple employers PF IDs, and transferring the amount to a personal savings account.

One should keep in mind online Transfer is only possible if:

- KYC details are seeded against the UAN.

- Only one transfer request against the previous member ID can be accepted.

- If previous / present (Exempted) trust bank account and IFS code are available.

- Please ensure that the personal information shown below is correct before proceeding with claim submission.

|

| Step 4 UAN ID login using Password / OTP |

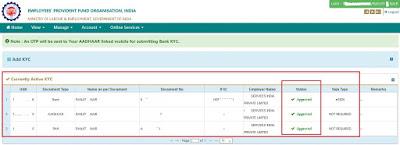

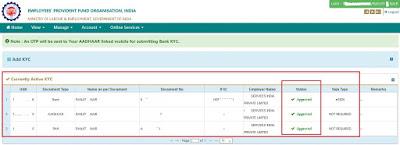

- Click on the Manage Option for E-Nomination and KYC Updates, without which one cannot transfer or withdraw available funds from the account. For updating KYC, once clicking on KYC under the manage option, the user will get an option for online KYC via bank, PAN, Aadhaar, and passport. Post submission with the above documents Status will be approved once only required actions can be taken. For updating e-nominations, one should update or complete the profile with a photograph uploaded. E-NOMINATION is available under the MANAGE option drop-down window.

|

| Step 5 E-KYC Updating Window under Manage option |

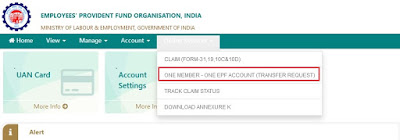

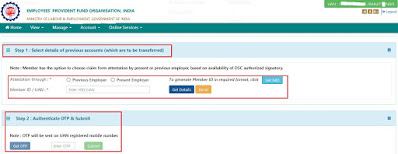

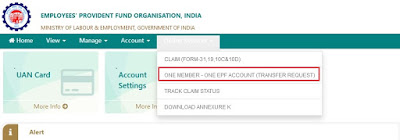

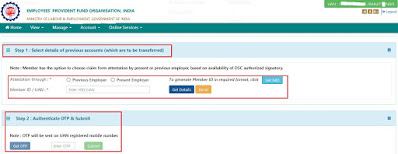

- And the final step is to click on the ONLINE SERVICES option over the portal and then click on ONE MEMBER, ONE EPF ACCOUNT (transfer request). Post-submission of the claim request, one can validate the claim status under the ONLINE SERVICES, TRACK CLAIM STATUS option. A field officer will be assigned after the submission of the claim request, who will verify the authenticity of the request and process the online application.

|

| Step 6 (a) EPF Transfer Window |

|

| Step 6 (b)Selecting UAN & Transferring post OTP validation |

Great 👍🏻

ReplyDeleteThanks Varun for the feedback !!

DeleteThanks Varun for the feedback !!

ReplyDelete