Life is really hassle-free if citizens know how to use technology in the right manner.

Visiting the RTO office to get things done was a painful task where citizens needed to take leave from the office, fill out the form, stand in a queue for hours, and at last, if required RC changes had not happened for the day, pay intermediaries bribes for getting things done quickly, leading to corruption, bossism, and duplicate efforts for the same tasks.

To mitigate and utilise the best possible use of technology, the government initiated faceless application processing of documents for more than 16 services held at RTO offices. Now citizens can avail of these services just by sitting at home and booking an appointment where a representative will visit the house and collect documents post-validation, or by applying directly via the official website with the help of uploading the requested documents.

As per the latest financial year data, 80% of passenger vehicles purchased in India are financed. Also, for two-wheelers, 40 to 50% are bought on loans, which means termination of hypothecation is required once the loan amount is paid once tenure gets completed or pre-paid in advance. When an individual buys a vehicle on loan, ownership always stays with the lender institution, and once the loan payment tenure successfully gets completed, or in the case of complete pre-payment of the loan amount, ownership needs to be transferred from the financial institute or lender to the original owner along with changes in insurance policy after the issuing of a new RC (registration certificate).

Hypothecation acts as mortgage collateral against repayment defaults to lenders or financial institutions. Lender has full ownership of the vehicle until the last successful payment is received from its customer, so in the event of any continued default in monthly EMI, the lender has the full right to sell off the vehicle.

To become the legal owner of your care Termination of hypothecation is equally important as loan repayment, as it helps in the smooth sale of cars in the near future.

The good news is that for termination of hypothecation, the customer does not require to visit RTO physically, as this can be done via online mode as well as through booking an appointment for a home visit by paying a minimal service charge. For booking an appointment, dial 1076 and select the appropriate options based on your requirements. For hypothecation termination, one needs to share the PUC (pollution certification number), mobile number, address details, active insurance policy details, and NOC received date from the lender.

An executive will take all the details and book or schedule a meeting where a representative will visit the customer's house on the scheduled slot and collect a copy of the below-stated documents. The customer needs to pay a nominal charge of Rs 50 to the representative, and after handing over the documents, it will take approx. 30 days to complete the changes requested.

Mandatory documents that need to be readily available before applying for termination of hypothecations are:

1) Form 35 will be sent via courier to the customer by the lender after successful completion of the last EMI payment without any default. This document is pre-filled with the vehicle number, engine number, and chassis number, along with a stamp from the financial institution. The customer needs to fill out registration authority details, the date on which they are submitting the form, and sign the above finance stamp section.

|

| Form 35 - To be issued by Financial Institution |

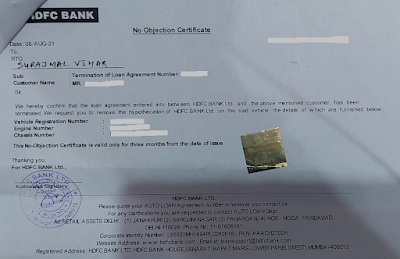

2) NOC (No Objection Certificate) - This is also issued by financial institutions after successful re-payment of loans, along with Form 35. It is valid for 3 months from the date of issue; hence, the customer needs to apply for hypothecation termination quickly; otherwise, after 3 months, one needs to re-apply for an NOC again, first from the lender, and then only apply for termination of hypothecation.

|

| NOC - Will be issued by Lender |

3) Insurance Certificate - The customer needs to make sure that valid (active) insurance documents are available at the time of submitting the request. Post-termination of the hypothecation, one should inform the insurance company of the changes.

|

| Insurance Certificate - In Valid Form |

4) RC (Vehicle Registration Certificate) - This is another important document to be available without which one cannot apply for Termination.

5) PUCC (Pollution Under Control Certificate) - Like insurance, PUC is equally important. So one should have a valid PUC number and certificate, which need to be submitted. Vehicles BS-I, BS-II, BS-III, and BS-IV, as well as vehicles plying on CNG or LPG, must have a PUC certificate, which gets renewed on a monthly and yearly basis after checking the pollution level (the test needs to be PASS).

|

| PUCC - Valid Date |

6) Aadhar card - During online registration of the Termination request on multiple intervals Aadhar based authentication via OTP needs to be performed. Specifically when an individual is submitting all the above documents via VahanParivahan e-Sign is mandatory which will be authenticated via Aadhar card only.

Below are the steps to be followed for Termination of Hypothecation via Official website VahanParivahan.

A) Sign Up through VahanParivahan where the customer needs to provide their full name, valid email ID, and mobile number, along with the state to be selected. After entering Captcha, click on Register. The user will get OTP details via email and mobile numbers provided for authentication. Once an account is validated, one can start exploring vehicle-related submissions.

|

| Vahan Parivahan Login/Registration Page |

B) Once Customer login into the Vahan Parivahan official website will get an option to select from the required services. There are other multiple faceless RTO Services can be availed which are categorized based on Vehicle and Permit Services basis below:

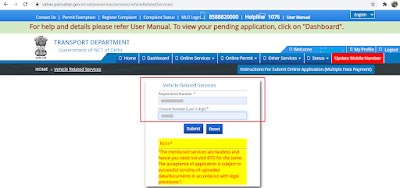

C) Click on Hypothecation Termination Option and over the next screen, the customer needs to mention the Registration Number (RC) and the last 5 digits of the chassis number of the vehicle, and then click on Submit to proceed to the next window, where the customer needs to input the Aadhar card, which is linked with the RC, and generate an OTP to validate the RC e-KYC. Once the Aadhar OTP is validated, the customer will see the auto-selected services, and there is an option to include other services if required; otherwise, just click on the Submit option to proceed.

|

| RC and Chassis Details window Aadhar Based Authentication |

- Ownership and insurance details are auto-filled; hence, customers only need to verify the details shown on the window.

- Under Service Details, one needs to share the hypothecation termination date, which can be based on the Form 35 and NOC documents received from the lender.

- DMS (Upload Docs) is where customers upload scanned versions of NOC, Form 35, insurance copy, and RC copy.

- Once all four documents are uploaded, the requestor needs to e-verify the uploads based on Aadhar OTP authentication.

- Then comes the last part of the application, the fee payment option, where the customer needs to pay service charges and submit the final application. After successful payment, it will take approx. 30 days to get the changes applied. Also, one can check the status of the application based on the application number generated for any rejections or additional details.

|

| Fees Details to be Paid |

Whether it's state or central government, there is lots of effort by government officials to put these new ways of getting things done in place, and as a responsible citizen, one should respect that and learn and adopt these changes in life.

Tags:

Latest Developments