Exchange Traded Fund, or ETF, acts as a passive investment instrument that is traded on the stock market like shares. It aims to track the domestic physical gold price. On a day-to-day basis, the price of the ETF keeps changing in accordance with the physical gold rate. One gramme of gold is equivalent to one gold ETF unit. All the gold ETFs are listed on the National Stock Exchanges and Bombay Stock Exchanges and are represented by 99.5% pure physical gold bars.

It's very important for an investor to diversify their portfolio considering the volatility situation of the global market; that's why investing in gold ETFs is considered a smart option. Also, holding gold in physical form is very risky and not advisable, as if an investor is shifting from one place to another, portability is another challenge. However, holding gold in paper or digital form through ETFs is the best option, and that too with a good rate of return is a smart option available in the current world. In 2019, the cost of yellow metal rose by approximately 18%, and the prices hit all-time highs.

There are some factors that make physical gold more expensive than ETFs because of the involvement of making charges, storing costs, security, and the jeweler's margin. Also, there is no compromise on quality, as the paper-format gold ETF is equal to the purest physical gold.

How Gold ETF model works ?

|

| Investment Model - ETF vs Gold Fund vs Direct buy |

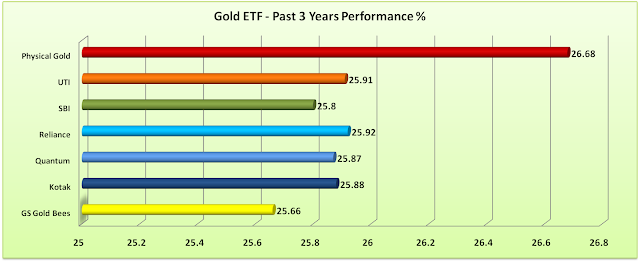

Gold ETFs past 3 Years Performance

Benefits of Gold ETF - As an investment suggestion prefer to invest in Gold ETF for short term or less than 5 years target !!

Total net asset percentage portfolio management between ETF and Mutual Fund.

How to invest in Gold ETF or Gold Funds ?

An investor must have a Demat account and a trading account with stock brokers to trade the gold ETF. Also, there is another option to have gold funds or mutual funds either via lump-sum or systematic investment modes as per the convenience of retail investors. If an investor wants to invest in gold mutual funds, then there is no mandatory requirement to have a demat account; however, PANCARD is a mandatory requirement. Investors must have the below requirements fulfilled first if investment will be done in gold ETF trading through Demat:

- PAN Card

- Bank account - Saving

- Valid Address proof

- Last but not the least Fund or ETF details (post research/trend analysis)