In today's era of smart investment, investors have the option to get detailed information on the stock's performance along with its future scope of return based on current demand and future growth prospects. From the past decade, Share Market has emerged as one of the favourite investment platforms for retail and big investors who are looking for the best rate of return in the short as well as long run. Owing to the presence of governing bodies like SEBI (Security Board Exchange of India), investors trust in the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange) increased. But as investments are subjected to market risks, it is always advised to do your own homework before investing in any stocks. History always repeats itself; one known example is Satyam, which went from trading at Rs 541 back in January 2008 to zero in the current year 2022. Investors lost their entire invested money (especially retail investors hard-earned money).

Based on my experience, most retail investors, during their early days of investment, always want to earn big profits from share trading (aggressive trading). Because of limited analysis, market study, and miscalculation, there is always an 80% chance of losing invested money. Back in 2012, I got a tip to invest in Educomp shares, which were trading between Rs 200 and 280.

I lost my entire Rs 80,000 bonus because of the half-knowledge concept as I have done short selling (selling shares with the perception they will fall more and later on buying them at a lower price). Ideally, if any investor is selling shares that he or she does not own, it is mandatory to buy the same before the closure of the share market, which is scheduled for 3:30 PM without a miss. Failure to purchase the same leads to big trouble in the form of a fine, the auction of shares, and a loss of traded value if the share price moves up rather than going down. I forgot to buy and lost all of my hard-earned money. Hence, the crux of the above real-time example is that investment requires knowledge, time, dedication, risk appetite, and an eye on market trends. Before investing in any stock, it is crucial to understand the different components of the company's growth strategy, future plans, and P/E ratio.

P/E - Price Earning ratio is most widely used tools by stock market investor to value a stock. The three different valuation criteria includes whether the stocks are:

80% of retail investors prefer undervalued stocks with a lower P/E ratio because there is always the possibility of maximising net worth or profit in the future. Undervalued stocks always have the potential for higher or better returns compared to overvalued stocks. This approach is also debatable because investors always need to be cautious when selecting the correct stock because not all stocks can be measured with the P/E ratio approach. However, it can be a good indicator that covers technical analysis of stock performance.

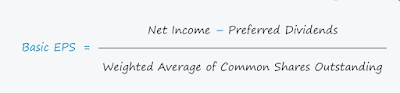

How P/E Ratio is calculated ?

In primary school, there are two types of P/E ratios: backward and forward. Backward P/E ration helps investors analyse historic rates of return, performance, etc. on which they decide to invest in target stocks in the future. The most widely used P/E ratio is the forward one because investors prefer to know where the company's growth percentage will be in the future along with its earning capacity. The focus is more on the future than past performance.

Based on the above formula, let's understand a real-time example of the P/E ratio of Hindustan Aeronautics Ltd.'s share. It is one of the best shares to invest in recent times. 6 months ago, it was trading around Rs 820, and now it has moved up to Rs 2455 per share, which means more than 100% return and that too within 1 year of timelines.

Hindustan Aeronautic is trading currently at a rate of Rs 2455 with an EPS (earnings per share) value of Rs 164.31. So if an investor wants to get the P/E ratio details, just divide 2455 by 164.31, which will be around 14.50 (approx). So the current P/E ratio falls between the fair and undervalued categories; hence, investors can invest for a good long-term return.

Now the biggest doubt is what range of P/E ratio considered as good for investing when any investor wants to buy a particular stock ?

A good P/E ratio is totally dependent on the sector and the company in which the investor is preferring to put their hard-earned money. Some sectors P/E ratios of 30 are considered good; however, for some industries, even P/E ratios between 10 and 20 are also considered good. The average market P/E ratio considered good ranges from 20 to 25. Sometimes a higher P/E ratio is considered bad, and a lower one is considered the best time to enter through investing. An ideal P/E ratio falls between 16 and 21. Again, depending on the sector selection, investors always need to do their homework and analysis before buying any stocks.

“The entrance strategy is actually more important than the exit strategy.” – Edward Lampert

Tags:

Smart Investment