Fundamental analysis plays a vital role in stock analysis, post-selecting the same and adding it to the current investment portfolio. As an investor, long-term stability in good stocks and patience are the only keys required for maximum wealth creation. We all know the respected Mr. Warren Buffett; he started his first stock investment at the age of 11 and his first real estate investment at the age of 14. But the point to be noted here is: at what age did he become a billionaire? The answer is yes, at the age of 56. After the age of 50, his wealth increased to $376 million. So we can say that most good investments require time, monitoring, and strategy (through diversification).

One can refer link : https://www.presentationpick.com/2023/07/how-do-you-determine-whether-stock-is.html for the first part of the stock picking strategy.

Let me share the facts or a real-time example of picking a good stock as a long-term strategy. Tata Steel was trading above 900 rs per share at one time. The stock got split to 100 rs per share, and shareholders got bonus shares in return. Post-split, the same stock went to 52-week low of Rs. 83. Currently, it is trading above 115 rupees per share. Basis long-term strategy stock has given a dividend of Rs 3.6 per share, which means if an investor is holding 2500 shares, they are getting Rs 9000, after tax rs 8100.

Dividend Confirmation

Current Stock Return

Basis above example, how we can pick the best stocks or what are the other key factors to be considered while doing fundamental analysis ? One of the well known factor is Shareholding Pattern.

Shareholding Pattern comprises of both promoters and non-promoters of the companies. It shows the companies ownership pattern. For transparency, it is mandatory to disclosure shareholder pattern to stock exchange in which company is listed. If the company is listed both in NSE and BSE, shareholder pattern needs to be disclosed to both the stock exchanges.

Promoters: Usually, promoters are individuals or institutions that help companies raise funds or capital. An increase in promoter stake is a healthy sign for the company, and it is considered a good buy. As per the SEBI guidelines, an organization should not have more than 75% promoter holdings. Based on the above data, Tata Steel's promoter % of 34.41 looks good.

Promoter holding % analysis:

Foreign Institutional Investors Or FII: These investors are usually not incorporated in India, but these investors or companies invest in India. These companies usually invest in developing economies, considering the high scope of growth opportunities. These investors or companies can be mutual funds, hedge funds, or insurance companies from the rest of the world. Too many FII holdings or a decrease in FII holdings is considered risky; if the holding is high, there is a chance that in the future FII may sell the stock in bulk, which leads to a sudden fall in stock value. There is an upper cap on FII's investment in the company's paid-up capital, which is 24%. FIIs for Tatasteel have increased since 2020, from 11.45% to 20.28% in 2023.

Domestic Institutional Investors or DII: Indian investors who put money in the Indian stock market intend to maximize their wealth by having profit as their main objective. DII can opt for insurance companies, mutual funds, liquid funds, and other investment sectors for capital diversification. As per the 2022 data, DII has invested approx. Rs 2 trillion so far, and the investment percentage is increasing day by day. In the performance of the Indian stock market, DII plays a key role. The upper cap of DII's investment has no limit as such, considering they are domestic investors. There is a little bit of concern about DII investment% since 2020; it got reduced from 29.87% to 20.96% in 2023. The decrease in DII shareholding pattern may not always be negative indicator as it might be owing to venture expansion, acquisition etc.

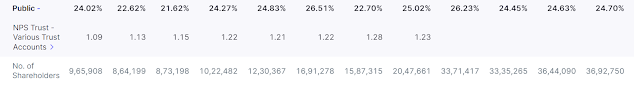

Public: Tata Steel's public holding percentage increased from 24.02% in 2020 to 24.70% in 2023. If we see the number of shareholders, there is a big jump from 9,65,908 to 36,92,750. One of the reasons might be the stock split from Rs. 800 to Rs. 100 per share. Shares look attractive, and small and retail investors now have the capacity to make positions because the current price post-split increases the buying percentage. Also, in the past few years, the company has expanded its business, and investors are seeing positive scope in terms of strategy, planning, and future growth.

Promoters buy stocks based on the balance sheet as one of the key criteria. BS reflects the company's financial position. It shows what the company owns in terms of assets and owes in terms of liabilities. A growing company always shows an increase in BS positions because the company's focus is to expand its business, which requires additional capital and manpower. With the right strategy and planning, at the end of the year there will be an increase in profit percentage and dividend payout. Back in March 2012, the total BS size of Tata Steel was 1,46,791 crores, which increased year by year to 2,85,396 crores in March 2023.

Another key criteria used while selecting a stock is the P&L statement. The profit and loss statement shows the income and expenditure position of the company. If the income is above expenditure, we can say that the company is in profit and managing its expenses well. As per the below P&L position of Tata Steel, operating profit increased year by year from 12,417 crore in 2012 to 32,300 crore in 2023. So fundamentally, the company is getting stronger and bigger year after year.

At the end of the day, correct stock selection totally depends on how well an investor has done their homework on fundamental and technical analysis. It's not gambling but a calculative mindset on the current and future prospects of a company, considering all the external factors in mind, like the global economy.

“If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.”