⌛Dividends are payments made by a corporation to its shareholders from its profits or reserves. These payments can be in the form of cash or additional shares of stock. Companies typically distribute dividends on a regular basis, such as quarterly, semi-annually, or annually. They're also an indicator of financial health. Companies that can consistently pay dividends are typically more stable and reliable.

That's not to say that a company that doesn't pay dividends isn't worth investing in, but those consistent payments can be a positive sign to an investor. Dividends can also offer a cushion in downturns; even if a stock's price drops, the dividend can provide a return to the investor.

⚓Blue Chip Companies: The company is a constituent of the S&P 500 index, Nifty50, BSE30 which are widely followed benchmark of the largest publicly traded companies in the India and U.S.

⚓Dividend Growth: The company has a track record of

increasing its dividend payment to shareholders for at least 25 consecutive

years.

These companies are considered highly reliable when it comes

to paying and increasing dividends, which makes them particularly attractive to

income-focused investors. The appeal of Dividend Aristocrats lies in their

ability to provide a consistent and growing stream of income through dividends,

even during economic downturns.

Here's why Dividend Aristocrats can be significant for

millennial investors:

📈Income Generation: Many millennials are in the early stages of their investment journey and may not have substantial capital to invest. Dividend Aristocrats can provide a source of regular income through dividends, which can be reinvested or used to supplement their current income.

📈Long-Term Growth: Millennials have a longer investment horizon, which means they can benefit from the compounding effect of reinvested dividends over time. By holding shares in companies with a history of dividend growth, they can potentially see significant wealth accumulation over the years.

📈Risk Mitigation: While all investments carry some level of risk, Dividend Aristocrats tend to be established, financially stable companies with a proven track record of weathering economic downturns. Investing in these companies can help millennials mitigate some of the risks associated with more speculative or volatile investments.

📈Inflation Hedge: Dividend growth often outpaces inflation, meaning that the purchasing power of the income generated by these stocks tends to increase over time. This can be particularly important for millennials planning for long-term financial security.

📈Diversification: Many Dividend Aristocrats come from various sectors of the economy, providing built-in diversification for an investment portfolio. Diversification can help spread risk and reduce the impact of poor-performing sectors.

📈Quality Focus: Dividend Aristocrats are typically companies with strong fundamentals, including solid financials and a history of profitability. This focus on quality can align with the investment preferences of millennials who prioritize sustainable and responsible investing.

📈Lower Volatility: They tend to be less volatile than high-growth stocks.

📈Total Return: They can provide a combination of income and potential capital appreciation in a portfolio.

It's important to note that while Dividend Aristocrats can be a valuable component of an investment strategy, they should not be the sole focus of an investment portfolio. Diversification across different asset classes and investment strategies is crucial to managing risk and achieving long-term financial goals. Additionally, it's essential for millennials to consider their individual financial goals, risk tolerance, and time horizon when making investment decisions.

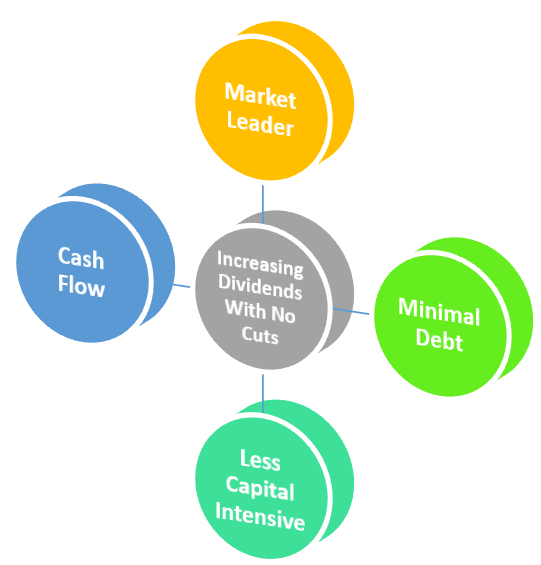

Here’s a few things to keep in mind when identifying the

next potential dividend aristocrats:

Benjamin Graham